Don't quit your day job (yet)

How to know when you’re financially ready to go out on your own.

A quick disclaimer: the information provided in this guide is for educational purposes only and should not be considered financial, tax or legal advice.

I quit my day job once.

The year was 2019. At the time, some friends and I had been hosting a podcast for two years on the side, and after a mildly terrifying pitch meeting, had landed a deal with Australia’s largest media network. For the first time we’d be recording in a proper studio, the same one as some of the country’s biggest radio stars.

It was exhilarating, and riding high on a promise and propped up by $50k in the bank, a few weeks later I made the shotgun decision to exit gainful employment and go all in. There was no concrete plan, other than to give it all I had for as long as I could.

Turns out, quitting your job before having a monetised product (let alone product-market fit) is the most stressful pathway to becoming self employed…I aged a decade in a year. And while I learned lots by throwing myself off the cliff, if did it again I’d quit my job at a different time, with different signals, under different circumstances. I’d think about it like this.

The Pathways

There are three main pathways from leaving your job to doing your own thing:

Quit your day job to pursue an idea or side hustle before it’s making money, without a plan to make money (high excitement, high risk, high stress)

Quit your day job to pursue an idea or side hustle before it’s making money, with a plan to make money (high excitement, medium risk, medium stress)

Quit your day job when your idea or side hustle is already making money (high excitement, medium risk, low-medium stress)

How do you decide which path to saunter down? And when is the right time? Before you make a shotgun call circa Anna Mack 2019, consider following these simple steps.

The Process

Disclaimer! The following example doesn’t take into account your personal circumstances, like your setup (sole trader vs. company), if you charge sales tax (VAT, GST), your business expenses, whether you have personal debt, a partner or children, retirement contributions etc. It’s designed to illustrate a methodology. Now that my ass is covered, let’s get into it.

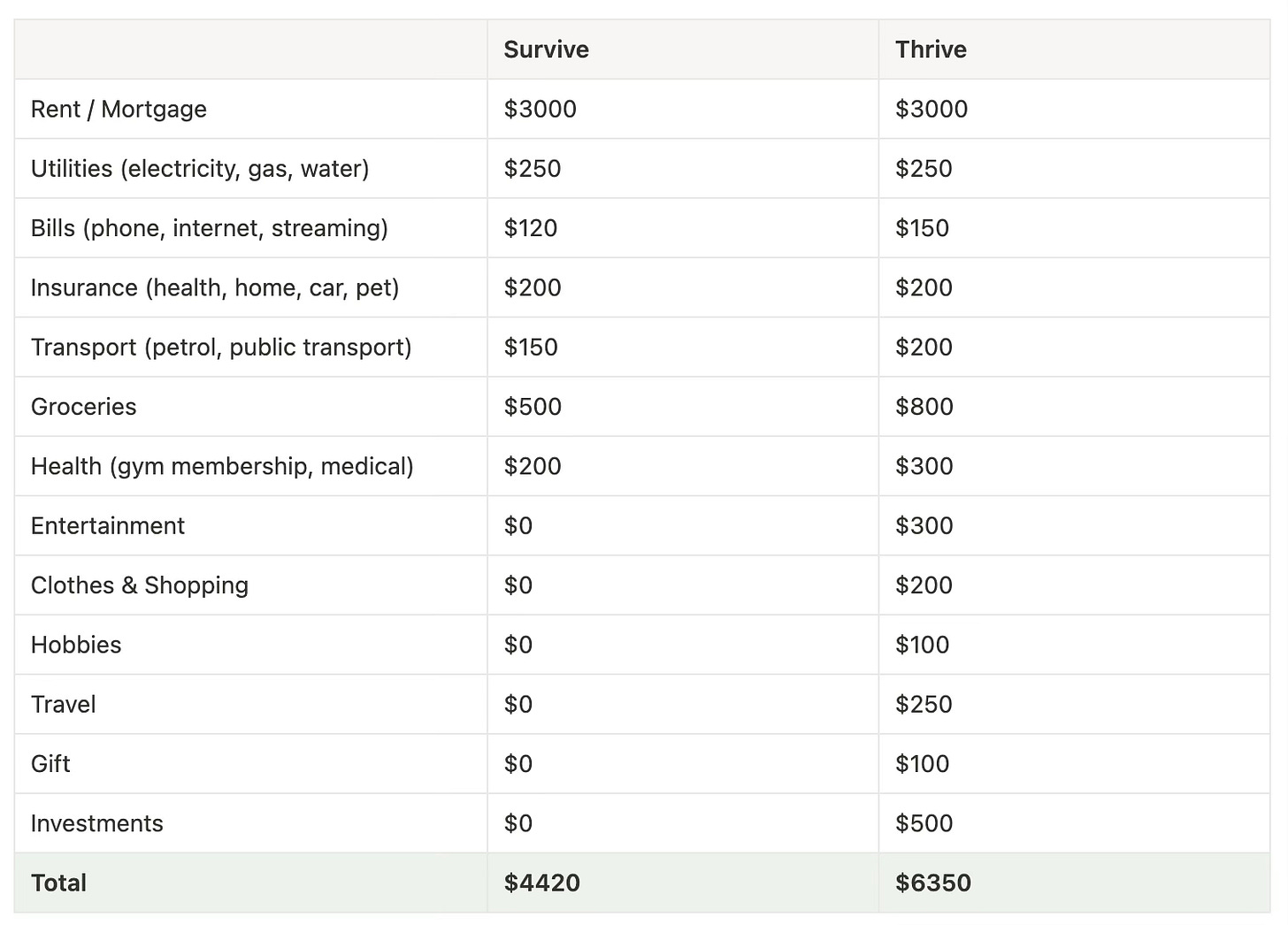

Step 1: Calculate your monthly survive & thrive numbers

If you’re not going to be banking a consistent pay cheque you need to understand your living costs and personal runway.

Your survive number is the bare minimum you need to cover your basic personal expenses. Your thrive number is the amount you need to live the lifestyle you want to live. Calculate both.

These two numbers represent how much money you need and want to take home each month while self employed:

Need = survive number = minimum take-home target

Want = thrive number = maximum take-home target

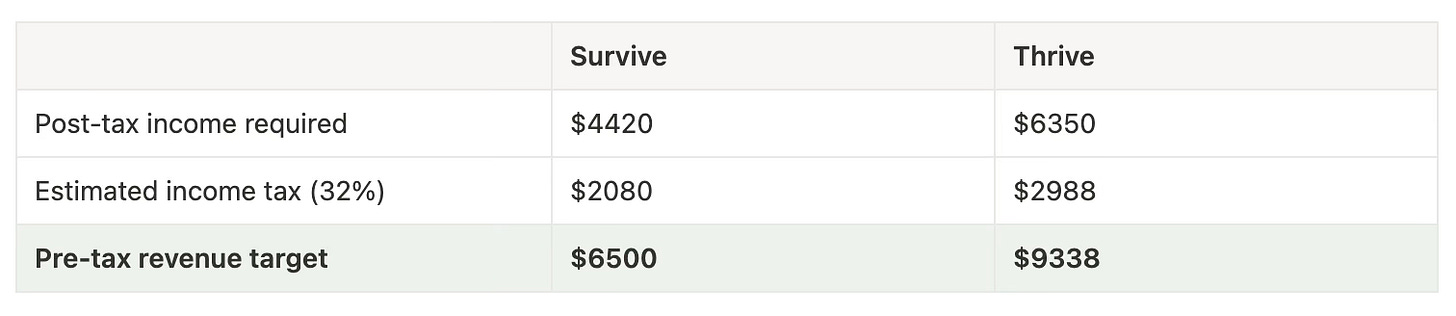

Step 2: Calculate how much you need to generate in revenue each month

How much you bring in and what you take home are two different things. Just because you’re banking cash it doesn’t mean it’s all yours to spend. That’s because, when you work for yourself, you need to pay the taxman after you earn income as opposed to your employer taking it out before.

That’s why you need to calculate a revenue target: how much money you need to generate each month to hit your survive and thrive numbers, taking tax into account.

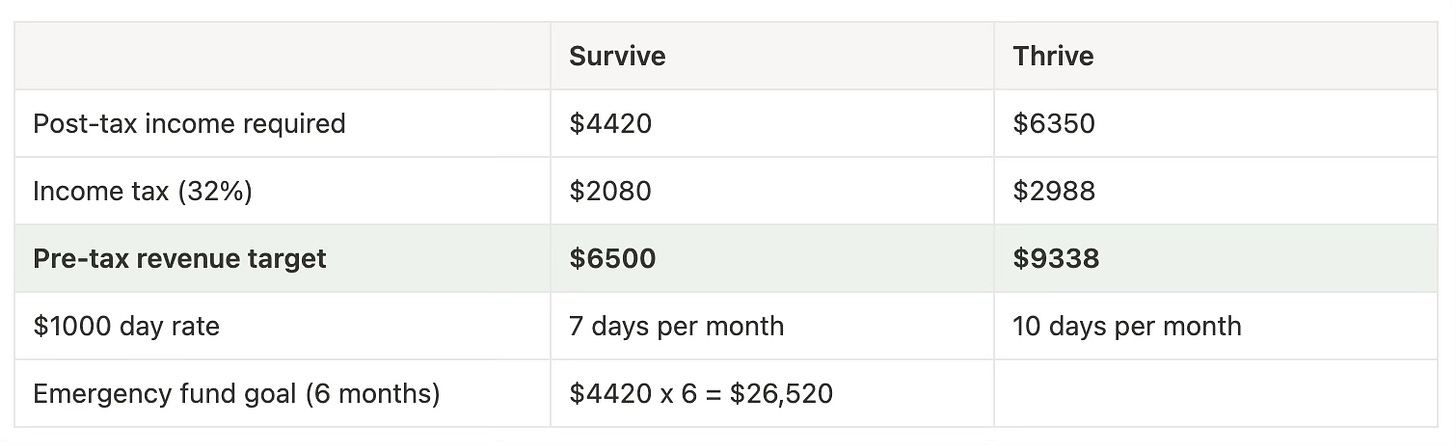

Let’s assume your average monthly income is taxed at 32% (this will change each month based on your cumulative earnings). To hit your min (survive) and max (thrive) income targets you need to bring in $6500 and $9388 in sales respectively.

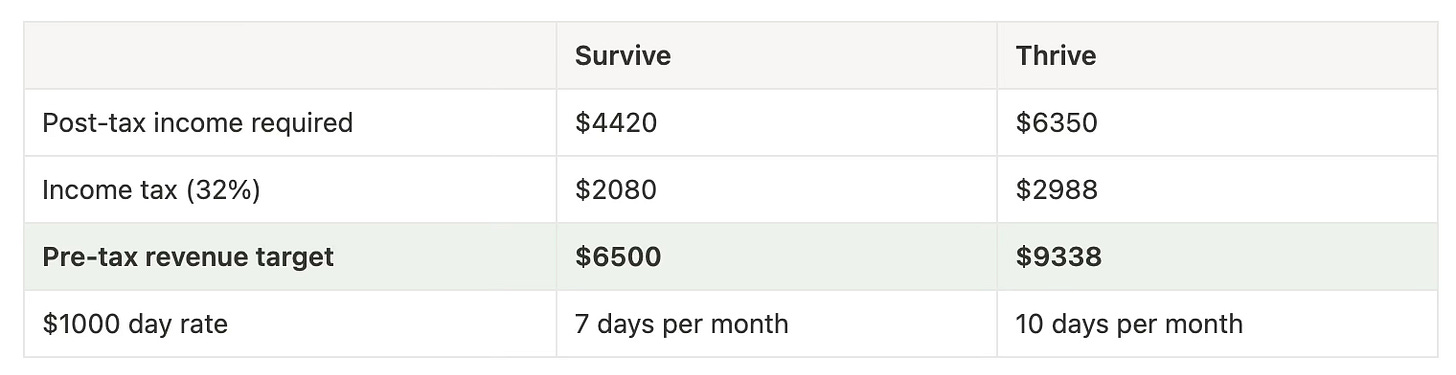

Step 3: Define your day rate or the price of your offer/s

If your goal is to build a portfolio career or one-person-business (like the majority of folks who read this newsletter) you’ll likely be selling your services to begin with. You can structure these in a few ways:

Tailored engagements, charged at an hourly or day rate, or on retainer

Productised services that have a fixed price and scope

Revenue sharing or performance-based agreements

In this example let’s assume you’re selling tailored engagements at day rate of $1000.

Step 4: Calculate how many hours/days or offers you’ll need to sell

Grab a napkin, flick it to the back and get out a pen - it’s time to do some math. How much time or how many offers will you need to sell to ensure your business is viable? Don’t forget tax.

You now know four things:

Your post-tax income targets (min-max)

Your pre-tax revenue targets (min-max)

Your offer and pricing, broadly speaking

How many you’ll need to sell to hit your min-max targets

At the most basic level you now have a simple income strategy for going out on your own.

The Action Plan

Step 5A: Build your network and generate future leads

Now the real work begins! It’s my POV that it can take 6-12 months of considered seed-planting to set you up for a smooth transition. While you still have a full time job, focus on:

Understanding your skills and playing with your positioning

Growing your network

Learning how to sell

Establishing an online presence

Creating an emergency fund (step 5B)

Step 5B: Calculate your emergency fund goal and save, save, save

While you’re still earning a salary it’s so! important! to create a personal slush fund that can act as a financial safety net in case, down the track, you lose all revenue overnight or have a few persistently low sales months. No good decisions are made from a place of desperation or scarcity, and my personal rule is to have 6 months of expenses (survive number) in a separate account. If you have a low aversion to risk this might be 3 months, if it’s high you might aim for 9 or 12.

Once you’ve crunched the numbers and put the plan in motion, all you have to do is work hard and wait for the signs. These will be different for everyone but they could be:

You’ve hit your emergency fund savings goal so you feel confident that if everything falls apart you have a defined amount of time (eg. 6 months) to figure it out

You’ve lined up projects or clients that cover a proportion of your survive number

You’re constantly turning down opportunities for work or side gigs that crop up during networking chats

Your gut is telling you it’s finally time to move!

Now…

If you’re reading this and freaking out because you’ve quit on a whim without knowing the numbers, don’t panic. The best time to do this exercise was before, but the second best time is now. Crunch those numbers, count those dollars, calculate those targets and create that plan.

I guarantee that over time - through failing and learning and stepping forward again - you’ll figure out the formula to a business and life that’s unencumbered, vibrant and full.

And that, my friend, is a math problem worth solving.

Managing many clients, projects, products and income streams can be complex and exhausting, but it doesn’t have to be. The Portfolio Career Operating System is all-in-one system designed to help you streamline workflows, reduce overwhelm and free up time, so you can focus on what matters most - doing great work, making more money and enjoying the life that you’re building.

It can help you:

Stay in control of your workload instead of feeling like you're drowning

Structure your time, tasks and energy to avoid burnout

Reduce context switching, and stay focused and productive

Create repeatable systems to manage clients, projects and income streams

Free up mental space by offloading ideas, insights and info into your second brain

Engineer financial security into your life even with variable monthly income

Curious? Watch the free 1 hour Info Session to see exactly how it works, and how it might transform the way you run your business and life.

I’m trying a new format! Let me know what you think 🙏🏼

🫶🏼 When you’re ready, here are three ways I can help:

The Portfolio Career Operating System: learn and implement the exact system I use to run my multi-six-figure portfolio of work across startup consulting and advisory, mentoring, writing, speaking gigs and digital products.

Watch the Free Portfolio Career OS Info Session: watch a 60 minute deep dive into all areas of the OS, so you can see it in action before buy.

Portfolio Career Mentoring: 1-1 sessions to help you build a career that sits at the intersection of freedom, creative fulfilment, meaning and money.

❤️🔥 Subscribe for more ideas and frameworks…

…to help you build a financially lucrative and creatively fulfilling portfolio career and life.

Genuinely so helpful — you took what seems like a bit scary mess and turned it into something that’s both simple and actionable.

This is such great advice Anna. I'd be hard pressed to think of many clients who've really considered this.